Level Up Your Finance Career – Financial Controller Academy. Unlock your potential and accelerate your journey in finance with the financial controller academy. This article dives into the offerings, benefits, and career paths associated with Controller Academy, exploring everything from course details and comparisons like CMA vs CPA, to practical insights on topics such as unbilled receivables and guidance on how to become a controller.

Financial controller academy

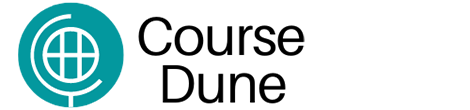

The financial controller academy, exemplified by platforms like Controller Academy, represents a paradigm shift in professional development for accounting and finance professionals. Gone are the days of solely relying on traditional, lengthy academic routes to achieve career advancement. These academies provide focused, efficient, and practical training designed to equip individuals with the skills and knowledge immediately applicable to their roles. Founded by industry veterans such as Bill Hanna, Controller Academy addresses the need for up-to-date, real-world knowledge that often isn’t covered comprehensively in standard academic curricula. The academy’s success is evident in its substantial subscriber base, positive reviews, and the impressive engagement metrics of its courses, confirming its role as a valuable resource for career-minded individuals looking to enhance their accounting and finance capabilities. This section explores the key features and benefits of the Financial Controller Academy.

The Rise of Online Accounting Education

The landscape of accounting and finance education is undergoing a significant transformation. The traditional reliance on university degrees and lengthy certifications is being supplemented, and in some cases challenged, by the rise of online learning platforms. Driving this shift is the increasing demand for specialized skills and immediate applicability in the workplace. Online platforms, such as Controller Academy, offer bite-sized, targeted courses that address specific skill gaps and provide just-in-time learning for professionals juggling work and career advancement.

This trend isn’t just about convenience; it’s also about relevance. Traditional academic programs can sometimes lag behind the rapid changes in accounting standards, financial technology, and business practices. Online academies, with their agility and industry-connected instructors, are better positioned to adapt their curriculum to reflect the current demands of the market. This adaptability is a crucial advantage for learners seeking to gain a competitive edge.

Controller Academy’s Mission and Vision

Controller Academy, founded by experienced accounting and finance professional Bill Hanna, sets out with a clear mission: to provide practical and efficient training that helps individuals advance their careers and gain valuable skills quickly. This mission is rooted in the understanding that time is a valuable asset, and professionals want to maximize their learning efficiency.

The vision behind Controller Academy is to create a learning platform that bridges the gap between academic theory and real-world application. By focusing on concise, easy-to-understand content and real-world examples, the academy aims to accelerate its students’ learning and career progression. The emphasis on practical skills and industry insights distinguishes Controller Academy from traditional educational institutions, making it an attractive option for those seeking a more direct and career-focused learning experience.

Measuring Success Through Key Metrics and Student Reviews

The success of a financial controller academy like Controller Academy isn’t solely based on the number of subscribers or courses offered; it’s measured by the impact it has on its students’ careers. Key metrics like subscriber growth, course completion rates, and student testimonials provide valuable insights into the effectiveness of the platform.

Controller Academy boasts impressive statistics, including over 250,000 subscribers, an average review score of 4.9/5 stars, and over 10,000 happy students. These numbers suggest that the platform is resonating with its target audience and delivering on its promise of providing valuable training. However, perhaps even more telling are the qualitative reviews from students who have benefited from the academy’s courses. Testimonials that highlight the conciseness of the lectures, the practicality of the examples, and the real-world applicability of the knowledge gained demonstrate the tangible impact of Controller Academy on its students’ professional lives.

Financial controller courses

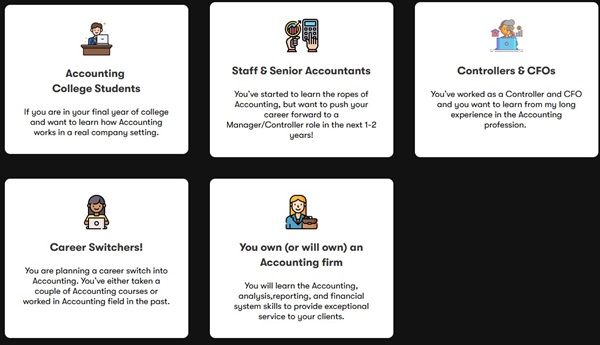

Financial controller courses form the backbone of any successful financial controller academy, providing the targeted knowledge and skills needed to excel in this critical role. Controller Academy offers a diverse range of courses, from foundational accounting principles to advanced financial planning and analysis techniques. Understanding the available course offerings, the specific content they cover, and the value they provide is essential for anyone considering investing in their professional development through a financial controller academy. This section will explore the typical topics covered in most Controller Academy, along with the types of financial controller courses.

Deep Dive into Core Course Topics

Financial controller courses should cover a wide range of essential skills and in-depth knowledge. These courses should provide a comprehensive understanding of the core topics to effectively manage financial operations within a business.

The financial controller courses dive into the topics ranging from creating KPI Dashboards, to mastering Excel, to acing Accounting interviews. They also cover complex topics like corporate tax, KPI Metrics. The offerings includes individual courses and course bundle providing great value, and cover the full accounting cycle. The comprehensive nature of the courses is designed to equip individuals with all the necessary tools for success in the field. The structured modules within the course allows a learner to easily grasp even the complex concepts. The combination of bite-sized video lectures, Excel templates, and quizzes offers a well-rounded learning experience, while the certificate of completion and lifetime access add further value to this already impressive course. The course topics include learning accounting equation, how to record transactions, period-end close, statements analysis, account payable management, Period-End Close Automation.

Structure and Format of Controller Academy’s Courses

Understanding the structure and format of financial controller courses is crucial in choosing the right program for individual needs and learning preferences. Controller Academy structures many of its courses as on-demand videos, which allows students to learn at their own pace from anywhere. The videos are short and to-the-point, ensuring the student’s attention remains intact.

The courses have hands-on exercises along with practical applications allowing people to learn while doing. The course have comprehensive sets of quizzes to evaluate learning process. The combination of different learning styles, that is visual, practical.

Benefits of Bundled Course Packages

Controller Academy, like many financial controller academies, offers bundled course packages to reduce cost and provide a comprehensive learning experience. These bundles offer a great way to learn a variety of disciplines to learn different expertise.

These bundles are not limited to cost saving but provide the complete learning experience through a curated collection of courses. Controller Academy have various bundles, that includes controller bundle, CFO bundle, and access to Entire Website bundle, it provides structured learning.

Cma vs cpa

The choice between pursuing a Certified Management Accountant (CMA) or a Certified Public Accountant (CPA) certification is a pivotal decision for aspiring accounting and finance professionals. Both certifications hold significant weight and credibility in the industry, but they cater to different career paths and skill sets. Understanding the nuances of CMA vs CPA, including their respective focus areas, exam requirements, and career opportunities, is crucial for making an informed decision that aligns with your long-term professional goals. This section provides an overview that compares both certifications to help you make a decision.

Delving into Key Differences between CMA and CPA

The CMA vs CPA debate is a common one among accounting students and professionals alike. While both certifications demonstrate expertise and competence in the field, they focus on different aspects of accounting and finance. The CPA is generally considered to be the gold standard for public accounting, focusing on auditing, tax, and financial accounting. CPAs are qualified to prepare and audit financial statements, represent clients before the IRS, and provide assurance services.

In contrast, the CMA is geared towards management accounting and financial management. CMAs focus on internal financial planning, analysis, control, and decision-making. They play a crucial role in helping organizations make strategic decisions, improve profitability, and manage risk. The key is to understand CMA vs CPA to achieve best results.

Unraveling Exam Structures, Content, and Difficulty levels

The exam structures, content, and difficulty levels of the CMA vs CPA exams are significantly different, reflecting the distinct focus of each certification. The CPA exam is notoriously challenging, requiring extensive preparation and a deep understanding of complex accounting principles. It consists of four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Each section is four hours long and includes multiple-choice questions, task-based simulations, and written communication tasks (in the BEC section).

The CMA exam consists of two parts: Financial Planning, Performance, and Analytics, and Strategic Financial Management. Each part is four hours long and includes multiple-choice questions and essay questions. While the CMA exam is considered to be less comprehensive than the CPA exam, it still requires a strong understanding of management accounting principles and analytical skills. The choice between the CMA vs CPA exam is a big one and should be done after thorough consideration.

Aligning Certification with Career Aspirations

The most important factor in determining whether to pursue a CMA or CPA certification is aligning it with your career aspirations. If you aspire to work in public accounting, providing auditing, tax, or assurance services to external clients, then the CPA is the clear choice. It’s a requirement for many positions in public accounting firms and is essential for becoming a partner.

However, if you are interested in working within an organization, focusing on financial planning and analysis, cost management, or internal decision-making, then the CMA is a more suitable option. CMAs are highly valued by corporations and organizations seeking to improve their financial performance and make strategic decisions. You need to understand CMA vs CPA to make the right decision for your path.

Controlling academy

The concept of a controlling academy, whether a formal institution or a collection of resources, emphasizes the development of specialized skills in controlling, also known as management accounting. Controlling academy is an important aspect to the function and impact on overall financial steering inside an organization. This academy, therefore, provides specialized instruction to provide trainees with skills to excel in this discipline. The academies should contain the crucial tools, technologies and tactics that are relevant to roles such as budget preparation, variance and performance evaluation in order for the experts to be highly competitive in the industry. This section examines the main elements in managing the organization and its position as a major driver of the management accounts.

Understanding the Role of Controller Academy in Organizational Success

The controller’s role has changed from being limited to that of an ordinary accountant to being an important business advisor. The controlling academy is becoming extremely important at building this expertise. Financial planning and analysis are part of their job, they do budgeting, manage performance, mitigate their risk in which they do not simply check figures. The courses offered at controllers should also be a combination of technical skills as well as softer skills like communication and leaderships to be effective as advisors to the management. To provide good training like that which are produced by successful controlling academies are useful for organizations to enhance their financial strategy and competitive strength.

Curriculum Components: Essential Skills and Expertise

Effective controlling academies require complex programs that equip members with the basic skills needed by controller roles. These include knowledge of sophisticated strategy regarding budgeting, variance reporting and performance reviews. However, the curriculum should incorporate modern technologies and best practices particularly in the areas of data analysing and financial software. Case studies, simulations, and practical projects are some of the methods that give participants relevant work experience. It is critically important that the controlling academy also stresses compliance with internal controls, governance, and ethical concerns. To be relevant in the modern business environment such complete and relevant education creates well-trained experts who can add enormous value to any organization.

Certification and Professional Development

The controlling academy should provide appropriate certification and continued education programs. Qualifications from recognized professional associations such as the International Management Accountants (IMA) or Chartered Global Management Accountants (CGMA) provide members with the requisite skills and credentials. Continuing education programs also enable controllers to stay current on changing accounting practices, technology upgrades, and changes in the legislation landscape. Opportunities involving webinars, workshops, and seminars also add value as they encourage networking and sharing best practices between colleagues. These certifications and professional development programs contribute to the competences of specialists in controlling, as well as increasing their value within their organizations.

Unbilled receivables

Unbilled receivables represent a critical aspect of revenue cycle management, particularly for businesses that operate on a project-based or service-oriented model. These are revenues that have been earned but not yet invoiced to customers, often due to incomplete project milestones, pending approvals, or delays in the billing process. Effectively managing unbilled receivables is essential for maintaining accurate financial records, optimizing cash flow, and preventing potential revenue leakage. Neglecting unbilled receivables can lead to understated revenue, inflated working capital requirements, and ultimately, reduced profitability.

Identifying Common Causes of Unbilled Receivables

The accumulation of unbilled receivables can stem from various underlying causes, often related to inefficiencies in project management, contract administration, or the billing process itself. One common cause is incomplete project milestones. If payment terms are tied to the completion of specific project deliverables or phases, delays in these milestones can lead to unbilled revenue. Another factor is the delays in the billing process if the billing process is manual or if it requires several levels of review and approval it is going to cause delay.

To effectively manage unbilled receivables, businesses need to identify the root causes of these issues and implement targeted solutions. This may involve improving project management practices, streamlining the billing process, or enhancing communication between project teams and the finance department.

Strategies for Minimizing Unbilled Receivables

Minimizing the accumulation of unbilled receivables requires a proactive and multi-faceted approach, focusing on process optimization, enhanced communication, and robust monitoring. One effective strategy is to establish clear billing policies and procedures, ensuring that all relevant stakeholders understand the requirements and timelines for invoicing. This includes defining specific milestones or triggers for billing, standardizing invoice formats, and implementing a systematic review and approval process.

Another critical strategy is to improve communication and collaboration between project teams and the finance department. Project managers should provide timely updates on project progress, potential delays, or any other factors that may impact invoicing. The finance department, in turn, should promptly follow up on any outstanding information or approvals needed to generate invoices.

Impact of Unbilled Receivables on Financial Reporting and Cash Flow

Unbilled receivables have a direct impact on a company’s financial reporting and cash flow. From a financial reporting perspective, unbilled receivables represent revenue that has been earned but not yet recognized. Under accrual accounting principles, revenue should be recognized when it is earned, regardless of when cash is received. Therefore, unbilled receivables should be recorded as an asset on the balance sheet, representing the company’s right to receive payment for services rendered.

However, if unbilled receivables are not properly accounted for, it can lead to understated revenue and an inaccurate representation of the company’s financial performance. This can have significant implications for investors, creditors, and other stakeholders who rely on financial statements to assess the company’s profitability and financial health.

From a cash flow perspective, unbilled receivables represent a delay in cash inflows. While the company has earned the revenue, it has not yet received the corresponding cash payment. This can create a strain on working capital and may require the company to seek external financing or delay other investments.

How to become a controller

Understanding how to become a controller, a senior-level management position responsible for overseeing the accounting and financial reporting functions of an organization, requires strategic planning and dedicated effort. The path to becoming a controller typically involves a combination of education, professional certifications, relevant experience, and the development of key skills. Aspiring controllers need to carefully consider each of these elements and tailor their career path to align with their long-term goals and aspirations. This section lays out the roadmap to prepare an aspiring individual for the controller roles.

Educational Foundations and Professional Certifications

A strong educational foundation is a prerequisite for aspiring controllers. Hiring organizations tend to prefer candidates with at least a bachelor’s degree in accounting, finance, or a related field. A master’s degree in accounting or business administration (MBA) can further enhance your qualifications and provide a competitive edge. A strong academic background provides foundational knowledge.

In addition to a relevant degree, professional certifications can significantly boost your credibility and career prospects. The Certified Public Accountant (CPA) and Certified Management Accountant (CMA) certifications are highly valued in the controller field. As discussed earlier, the CPA is more focused on public accounting and external reporting, while the CMA is geared towards management accounting and internal financial management. While understanding CMA vs CPA, will help the aspiring candidates to focus.

Gaining Relevant Experience and Building a Skill Set

While education and certifications are important, practical experience is essential for how to become a controller. Aspiring controllers typically start their careers in entry-level accounting positions and gradually progress through roles of increasing responsibility. Common entry points include staff accountant, financial analyst, or auditor.

As you progress in your career, seek opportunities to expand your skill set and gain experience in various areas of accounting and finance. This may involve working on different types of projects, taking on additional responsibilities, or volunteering for cross-functional teams. The ability to work with the team is key.

Networking and Building Relationships

Networking and building relationships with other professionals in the accounting and finance field can be invaluable for career advancement. Attending industry conferences, joining professional organizations, and connecting with colleagues on social media platforms like LinkedIn can provide opportunities to learn from others, share insights, and identify potential job openings.

Networking can also help you build relationships with potential mentors who can provide guidance and support as you navigate your career path. A mentor can offer valuable advice on career development, skill building, and navigating office politics.

Conclusion

The journey to becoming a successful accounting or finance professional, and specifically a controller, demands a combination of strategic education, professional development, and focused experience. A financial controller academy like Controller Academy can significantly accelerate this process by providing targeted, practical training in core skills and competencies. These academies, supplemented by recognized certifications and strategic career planning, contribute to the professional development needed to excel in today’s dynamic financial landscape. As demonstrated, areas such as a detailed understanding of the CMA vs CPA certifications, the proper financial controls over things like unbilled receivables and a focus on continuous learning are integral pieces to how to become a controller.

Sales Page: _https://controller-academy.com/